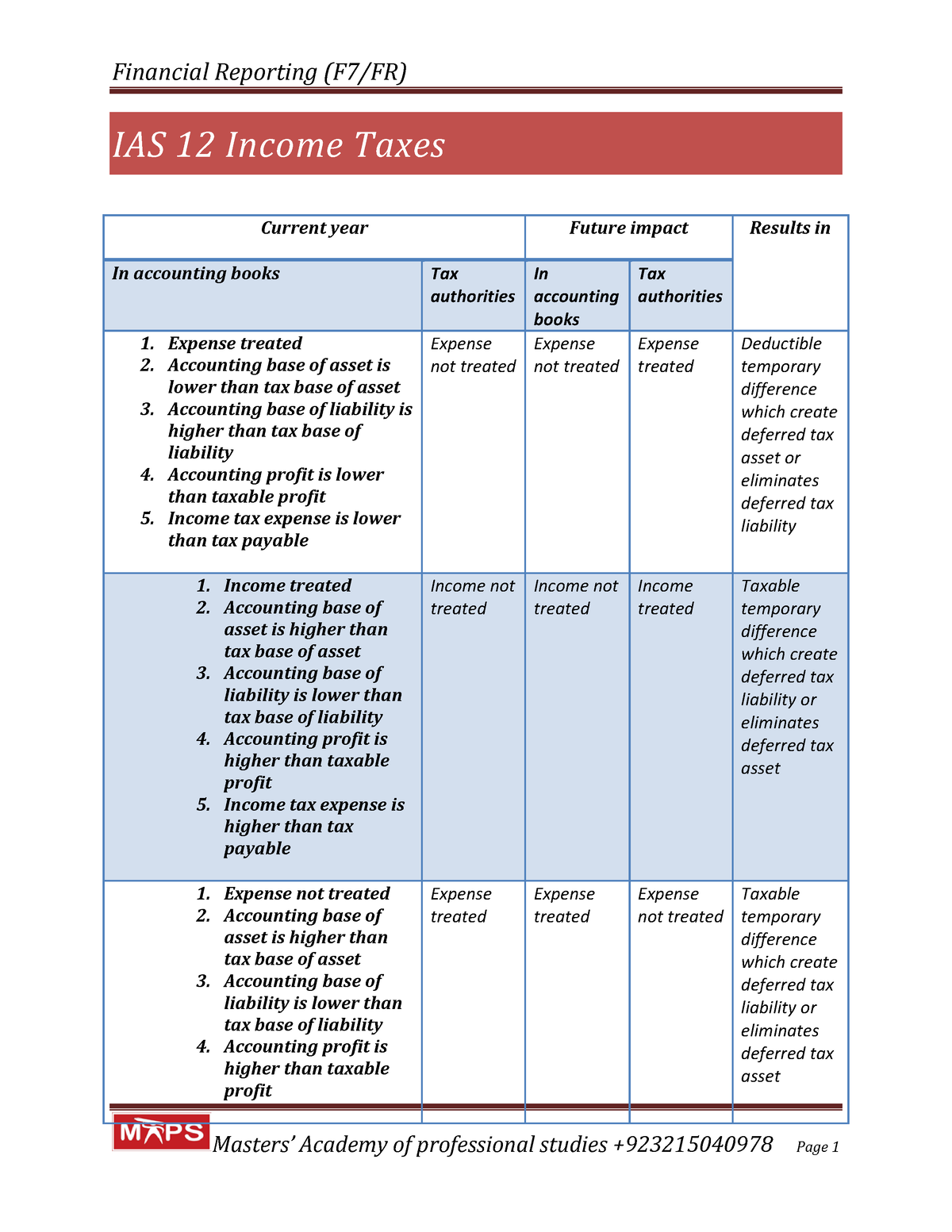

IAS 12 income taxes F7 - Nice note - IAS 12 Income Taxes Current year Future impact Results in In - Studocu

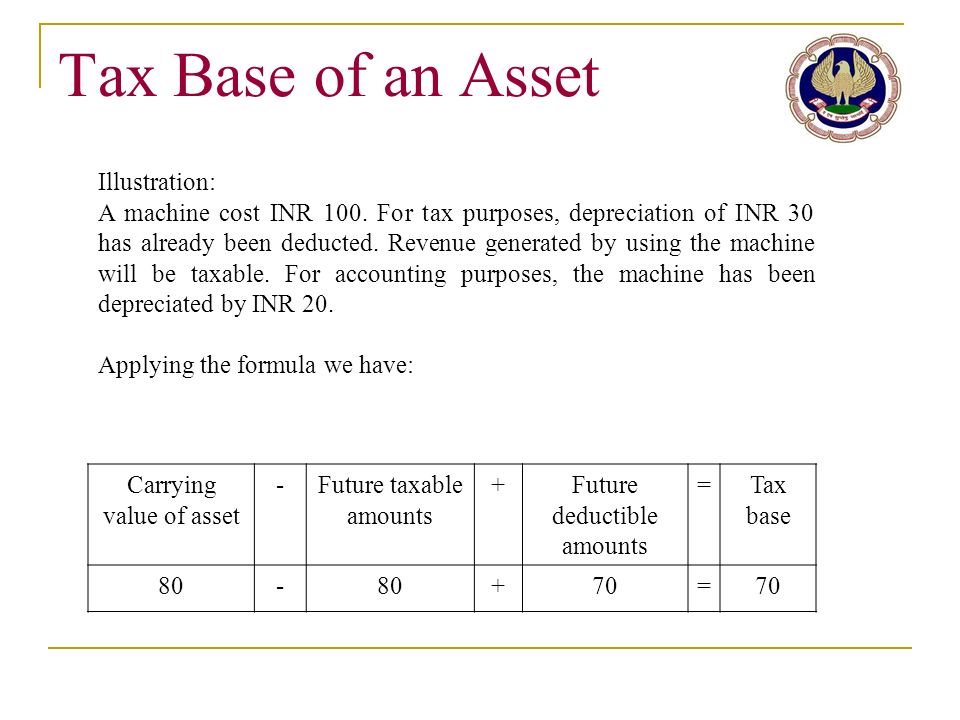

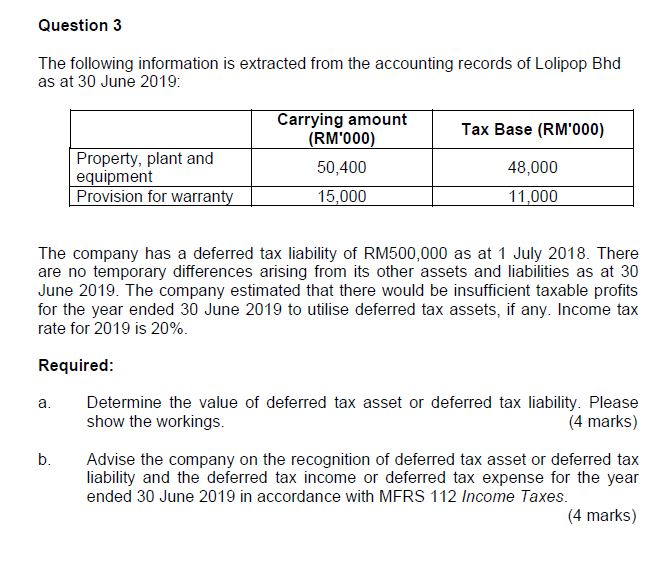

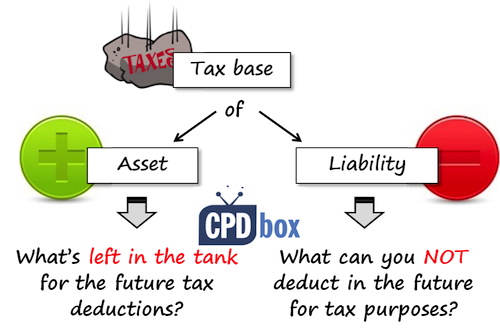

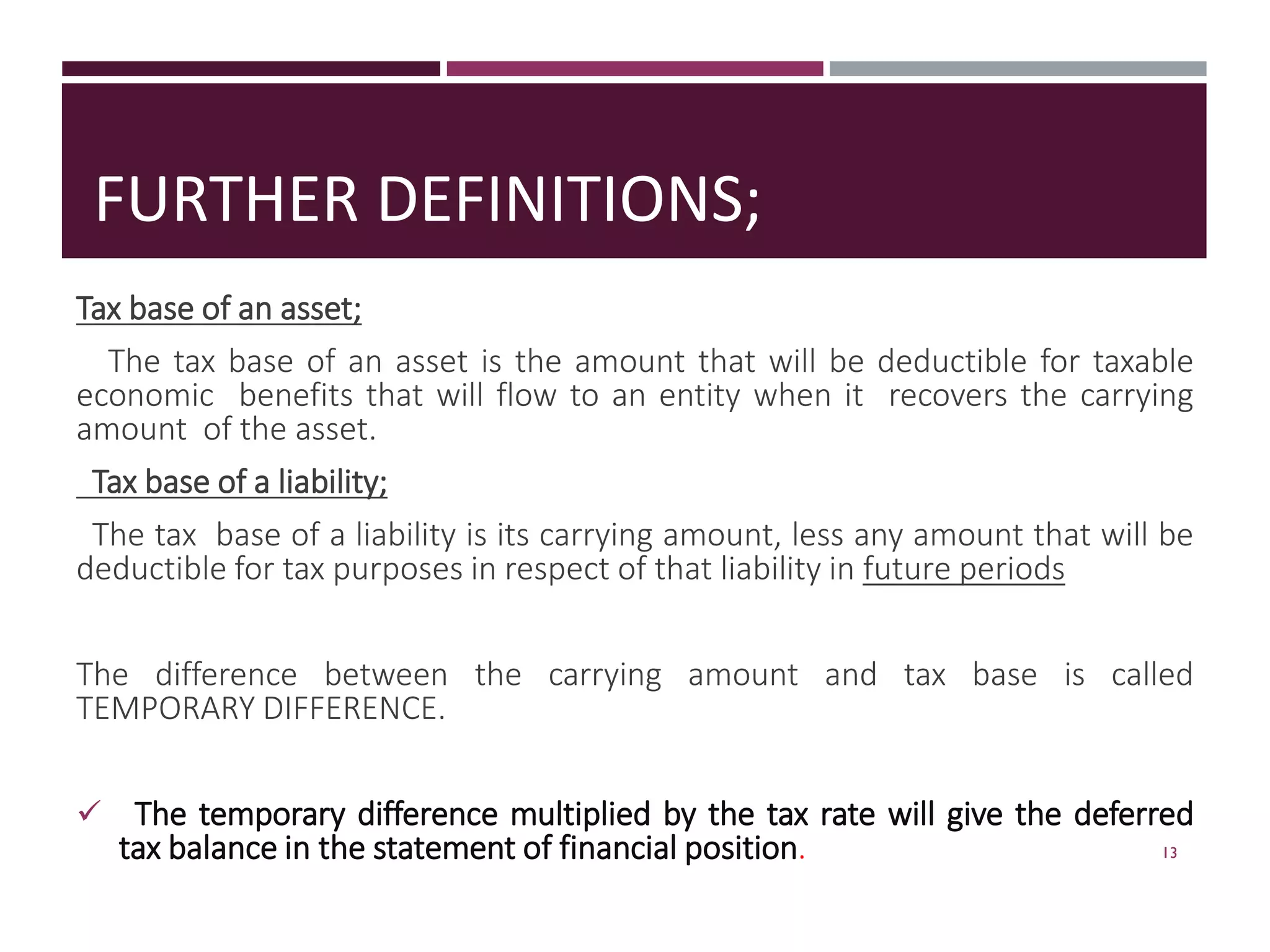

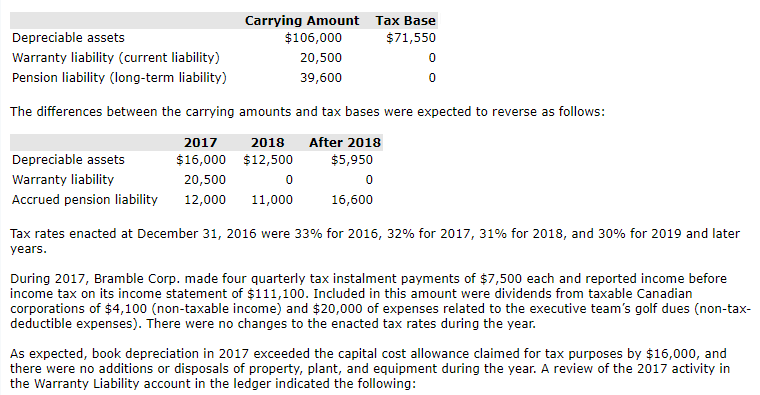

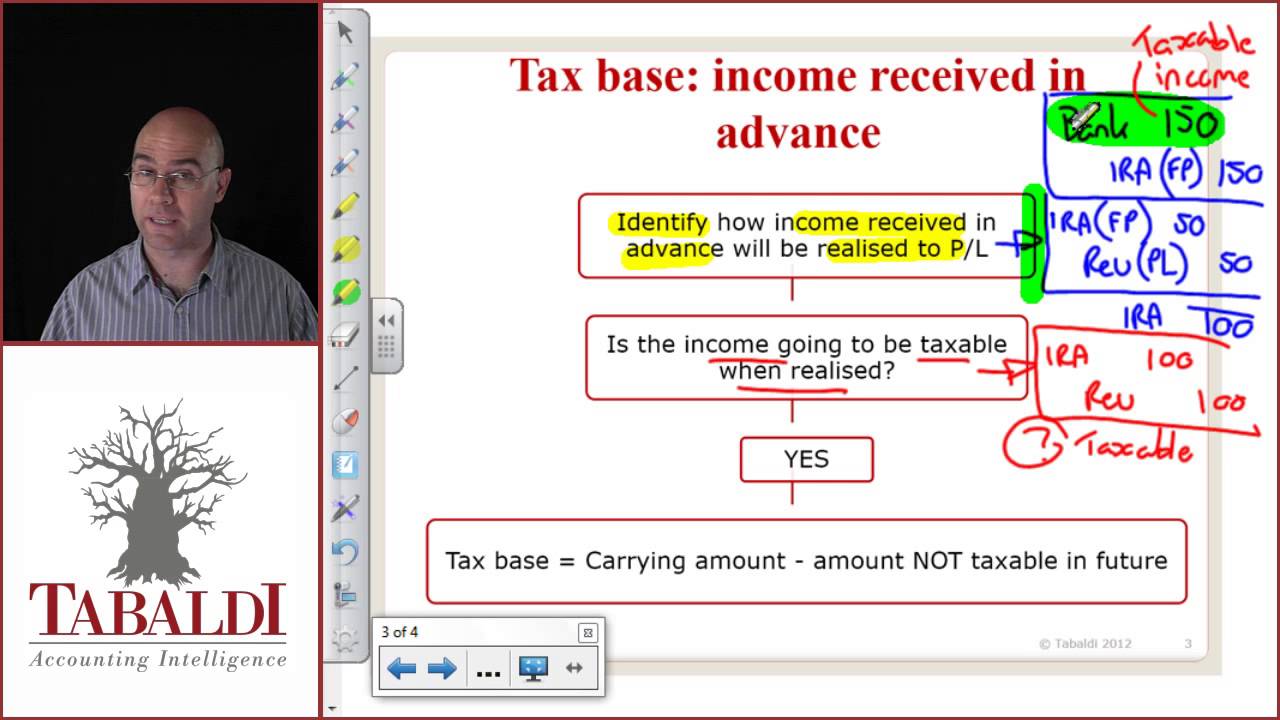

Cacique Accounting College - Today's topic - ACCA P2 - Corporate Reporting - Deferred Tax…😊 A Deferred Tax liability is an account on a company's Balance Sheet that is a result of